Something that’s frustrating about investing in non-purely-software companies is the poverty of vocabulary. People talk about “deep tech”, “hard tech”, “frontier tech”, “atoms”, and so on. Sometimes they just mean to distinguish hardware from software companies, sometimes to distinguish technical moonshots from more immediately commercial ventures.

Despite the linguistic fuzziness, I’ve found myself mentally bucketing

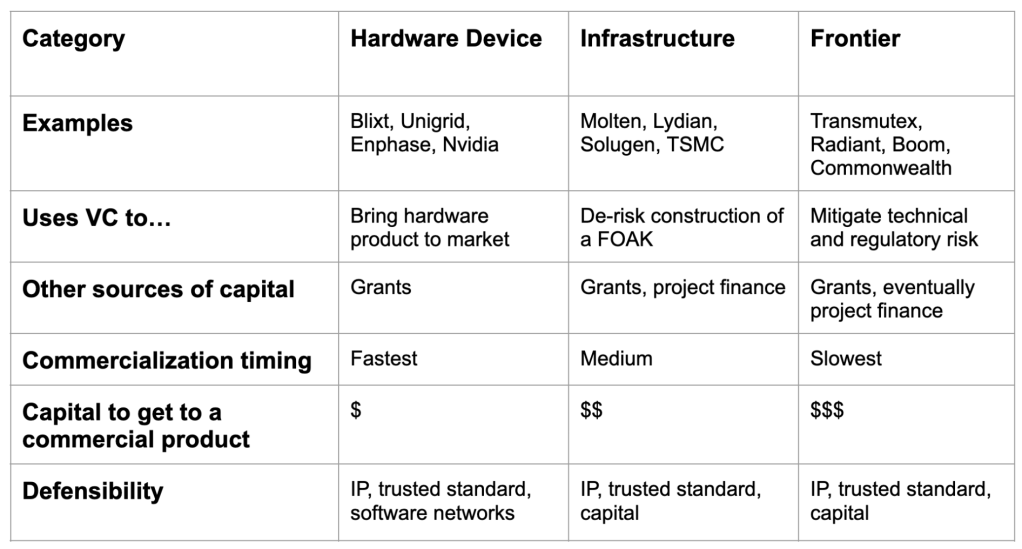

deep tech” companies into three primary categories: hardware device, infrastructure, and frontier.

Hardware device companies (or “Hardware as a Product”?) develop and sell novel hardware. That hardware could be anything from a battery to a sensor or a chip. These companies commercialize fairly quickly, using early stage venture capital to get to market and then to improve and expand their product offerings. Although they might eventually vertically integrate, hardware device companies are usually able to use contract manufacturers because their innovation is more in the design of their hardware than its production process. In the earliest days, these companies need technical leaders to build their products, but then they pretty quickly have to build a sales organization to get their products into customers’ hands. Like software businesses, hardware device companies have some ability to iterate on their products based on market feedback– and can therefore take more market risk. Novel hardware devices can also anchor new software networks based on real-world data and actuation, creating greater defensibility. They might also benefit from grants early on if they’re aligned with DOE or DOD objectives.

Eg: Blixt, Unigrid, Enphase, Nvidia

Infrastructure companies develop new hardware with the goal of using that hardware to produce and sell some commodity. These companies typically use early rounds of venture capital to scale and de-risk a production process and then eventually raise growth capital to build a commercial-scale facility to run that process. Successfully constructing a first commercial-scale facility creates value for the company in two ways: it offers a step-change increase in revenue and also demonstrates the viability of a model that can be replicated with less risk. In addition to hiring great engineers to develop their novel process, infrastructure companies have to excel at project development. Infrastructure companies can take different approaches to getting facilities built (eg licensing, joint venture, co-location, etc), each with its own capital requirements, financial upside, and level of execution risk. Infrastructure startups might have access to grants to supercharge venture capital for funding bench-scale work and can potentially bring outside project finance to their projects instead of funding them entirely from their balance sheets.

Eg: Molten, Lydian, Solugen, TSMC

Unlike hardware device companies, which use venture capital to scale device sales, or infrastructure companies, which use venture capital to physically scale up a process, frontier companies don’t use venture capital to scale existing tech but to develop technology at the limits of what is currently feasible. Although they might make money by licensing intermediate technologies on their path to developing some breakthrough, they’re fundamentally in the business of reaching successive technical and regulatory milestones to justify further venture investment and government support. They take the longest to get to market, often not fully commercializing until after a successful exit. But, once they do commercialize, they grow very quickly, gaining a large, defensible share of a massive market through capital, IP, and regulatory moats. These businesses are similar to biotech startups in that both use venture capital purely for R&D and create value through technical de-risking. One interesting difference from biotech, however, is that frontier tech companies are usually less dependent on M&A for distribution.

Eg: Transmutex, Radiant, Commonwealth Fusion, Boom Supersonic

To summarize:

Leave a comment